How criminals use online bank transfers to stalk, harass domestic violence victims

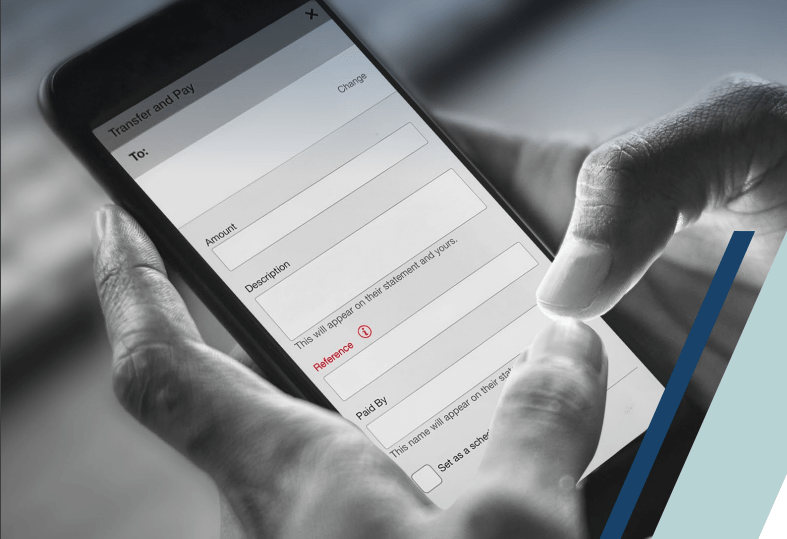

Criminals and perpetrators of domestic violence are using a message field in online bank transfers to stalk, harass and intimidate as well as communicate about crimes.

The Federal Government’s financial intelligence agency, Austrac, has released details of the ways the payment text field or reference field in online transfers is being used by criminals.

In a new financial crime guide, Austrac says there is an increase in misuse of the payment system for communication between criminals or with victims for the purpose of harassment, intimidation or abuse.

The payment text fields are meant to be used for reference when making online payments.

“Instead, the transaction text fields are being used with increasing frequency to communicate for the purpose of stalking, harassing and threatening behaviour or to avoid law enforcement scrutiny,” Austrac says in its latest financial crime guide.

Austrac says there have also been instances of communications involving child abuse material, illicit drugs, firearms, ideologically-motivated extremism and outlaw motorcycle gang activity.

You might like

In one case study, cited by Austrac, a 33-year-old male sent 170 payments to a female over a five-month period. The payments were valued at $1 or less and the payment text fields included references to reporting the offence to police, labelling the 43-year-old woman a pig and abusive and threatening language.

Police were notified and the male was charged with breaching a protection order.

In another case, a 23-year-old male sent 10 payments valued under $5 each to a female over a five-week period.

Messages in the payment text field asked the woman to contact him and contained threats that he was planning to take his own life. Police were notified and it was found the messages were sent in breach of a protection order. The man was arrested and charged with breaching a protection order by communicating with the victim via financial transactions.

Stay informed, daily

Austrac makes the point that a lack of offensive or abusive language in the payment message did not always mean it was harmless. These included statements like “This is your fault”, “Don’t do this to me”, “Thinking of You”, “I just want to talk”.

“Some perpetrators of technology-facilitated abuse remove explicit threats or profanities in an attempt to legitimise payment text or avoid scrutiny by financial service providers,” the report says.

Austrac says that criminals can also reference the supply or shipment of illicit goods or a planned event.

“This type of offending will take the form of a two-way conversation with small value payments sent between individuals.”

And the report notes that some payment platforms allow for emojis to be included.

“Different emojis can be used to convey threatening or abusive messaging to a payment recipient. This can include emojis depicting weapons, injury or death or a sexual connotation.”

Research from Westpac shows that one in two Australians have received some form of online abuse, including via email, mobile and social media channels. One in four admit to having used some form of inappropriate language in payment transactions.

And a recent YouGov survey, commissioned by Commonwealth Bank, showed almost 40 per cent of Australians responded that they had experienced or knew someone who had experienced financial abuses.